SUBPART A–GENERAL

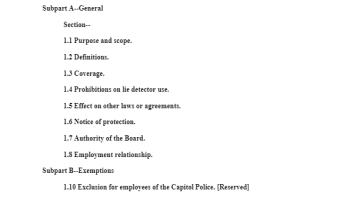

Sec. 1.1 Purpose and scope.

Enacted into law on January 23, 1995, the Congressional Accountability Act (“CAA”) directly applies the rights and protections of eleven federal labor and employment law statutes to covered employees and employing offices within the legislative branch. Section 204(a) of the CAA, 2 U.S.C. 1314(a) provides that no employing office may require any covered employee (including a covered employee who does not work in that employing office) to take a lie detector test where such test would be prohibited if required by an employer under paragraphs (1), (2) or (3) of section 3 of the Employee Polygraph Protection Act of 1988 (EPPA), 29 U.S.C. Sec. 2002(1), (2) or (3). The purpose of this part is to set forth the regulations to carry out the provisions of Section 204 of the CAA.

Subpart A contains the provisions generally applicable to covered employers, including the requirements relating to the prohibitions on lie detector use. Subpart B sets forth rules regarding the statutory exemptions from application of section 204 of the CAA. Subpart C sets forth the restrictions on polygraph usage under such exemptions. Subpart D sets forth the rules on recordkeeping and the disclosure of polygraph test information.

Sec. 1.2 Definitions

For purposes of this part:

(a) “Act” or “CAA means the Congressional Accountability Act of 1995” (P.L. 104-1, 109 Stat. 3, 2 U.S.C. Sec. 1301-1438).

(b) “EPPA” means the Employee Polygraph Protection Act of 1988 (Pub. L. 100-347, 102 Stat. 646, 29 U.S.C. Sec. 2001-2009) as applied to covered employees and employing offices by Section 204 of the CAA.

(c) The term “covered employee” means any employee of (1) the House of Representatives; (2) the Senate; (3) the Capitol Guide Service; (4) the Congressional Budget Office; (5) the Office of the Architect of the Capitol; (6) the Office of the Attending Physician; (7) the Office of Compliance; or (8) the Office of Technology Assessment.